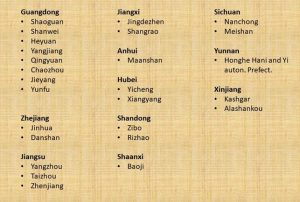

On February 8, 2022, the announcement no. 8 of the State Council established 27 new CBEC – Cross Border E-commerce pilot zones, in corresponding 27 Chinese cities (amongst them, Yangzhou, Taizhou, Zhenjiang, Jinhua, Ma’anshan, Jingdezhen, Zibo, Rizhao, Xiangyang, Chaozhou, Baoji, Ordos, Kashgar, Alashankou, and others).

- 2022 New 27 CBEC Pilot Zones: where, and why?

The total number of CBEC Pilot zones in China is 132 sites, now covering almost the whole country.

From 2015 on, Chinese Government pushed the CBEC policy to boost both internal demand and international trade, by establishing CBEC pilot zones with five different batches. In the current 2022 batch (the sixth one), the choice focused both on top-tier provinces (especially Guangdong, with eight new CBEC sites, and Jiangsu-Zhejiang, with six new sites), and on specific areas close to western and southern borders between China and Khazakstan (Alashankou), Vietnam (Ordos), and along the Silk Road, through the new pilot zone in Kasghar, close to the border between China and Pakistan, Tajikistan, and Afghanistan, one of most important hubs for cross-border trade between Western China and Central Asian Countries.

Furthermore, in top-tier provinces enjoying the new pilot zones (Guangdong, Jiangsu, and Zhejiang), now all Prefecture-Level cities are within CBEC pilot zones.

Indeed, the establishment of these new 27 CBEC pilot zones strengthens the CBEC policy as main way for international trade and contributes to accelerate the rapid development of Foreign-Chinese trade.

- Now CBEC policy is “automatically applicable”

For the first time, the announcement no. 8 states that for those pilot zones who already in compliance with provisions on supervision and administration required by local Customs Administration, the rules of CBEC policy shall apply automatically. While, instead, the preceding establishment acts by the State Council never stated any automatic implementation, it is now possible for foreign operators to further accelerate the concrete execution of the CBEC business by using the facilities located in the designated areas and provided by the over 100,000 Chinese companies involved in CBEC.

- Numbers on CBEC

Since 2015, CBEC has been representing the most relevant channel for Sino-Foreign international trade, both in B2B and B2B2C: during the pandemic, the growth of CBEC has been remarkable, achieving over 260 billion USD in year 2020, and 310 billion USD in year 2021, according to official data by the General Administration of Customs. Despite the disruption of logistic chain due to pandemic restriction, CBEC continues to lead the Foreign-Chinese international trade, both in Export and in Import.

Within CBEC, the role of retail market is remarkable: with over 600 million of Chinese consumers registered in CBEC retails platforms (especially T-Mall Global, JD Worldwide, and Kaola together handle almost the 75% of the total CBEC retail commercial exchange), Chinese retail market has been overtaking the restrictions imposed during the COVID-19 pandemic, as if anything was happened.

- CBEC main features confirmed

Eligible goods

Recent announcements by State Council on establishment of new CBEC pilot zones never amended or modified the “Positive List” system to select those goods eligible for being traded on CBEC platforms. To date, the Positive List includes 1.321 commodity categories, classified by their HS code.

Generally, if a certain HS code is included in the List, and no restrictions appear related to that HS code, all commodities within the said HS code can be deemed as eligible for CBEC. Sometimes, there are some sub-restrictions which prevent certain goods of a certain HS code from being imported and sold in China.

Of course, according to AQSIQ regulations, nor prohibited items neither those products which were already unallowed for import or sale in China via normal import procedures, can be purchased or imported via CBEC channel. For example, used items, dangerous items, animal, or plant products, etc.

Taxation

Generally, where a certain good is imported in China, some tax issues must be considered, such as:

- Import tariffs à % variable depending on the imported good

- VAT à 13%

- Consumption Tax à % variable depending on the imported good

Where goods are sold through CBEC Channel, the special policy for this kind of transaction lifts tax burden, so that

- Import tariffs à set to 0% as total exemption

- VAT à dropped as 9.1%

- Consumption Tax à 30% off for most part of goods included in Positive list

Logistics

Indeed, logistic chain has been the most affected sector amongst industries involved in CBEC, due to Pandemic restriction. Although, as said, during these two years CBEC has registered a continuous growth both in terms of value of transactions and of sales.

Two patterns may be used for CBEC purpose.

- Bonded warehouse: this logistic solution (B2B2C) can be handled throughout a special warehouse duly established within the CBEC areas, generally handled by CBEC Platforms, and under the supervision of Chinese Customs. Goods may be shipped into the bonded warehouse and stored there. Customs handles the Customs Clearance upon receiving the goods into the bonded warehouse, although these goods cannot be considered as “imported” until a consumer makes a purchase order on the CBEC online platform. Thus, both Import duties and VAT are postponed until the purchase order is made. Goods eligible for this logistic model are those under the Customs code 1210.

- Direct international purchase: for goods under the Customs code 9610, a different logistic pattern (B2C) must be followed, based on direct purchase and shipping from abroad. According to this model, Customs Clearance is handled upon the submission of purchase order. At that time, Chinese Customs handle the Customs Clearance procedure. Then, purchased goods are shipped directly to the purchaser. Although for CBEC it is not necessary to incorporate a Chinese legal entity, this pattern requires to have a contractual relationship with a local Trade Partner. In terms of duration of shipment, this model requires one or two weeks, since the goods are not in Chinese territory where they are purchased.

Customs Clearance and license requirements

After being clarified and standardized in 2018, CBEC customs policy is still in force for all CBEC pilot zones around the Country: According to the Notice no. 486 of November 28th, 2018 (jointly issued by several Government bodies involved in CBEC: Ministry of Commerce; Development Reform Commission; Ministry of Finance; General Administration of Customs; General Bureau of Taxation; State Administration of Market Regulation), for those products imported via CBEC channel, the transaction is deemed as import of commodity for personal use, so no requirement for licensing, registering or other regulatory authorization for first-imported goods shall apply. Thus, several good belonging to regulated markets – such as, some imported cosmetics, some health food, etc., may enjoy of CBEC opportunity to be sold as commodities within the Chinese retail e-market without being registered by Chinese regulatory bodies.

Of course, a specific analysis must be handled with referral to each product to check its eligibility for CBEC purpose within the Positive list.

- What else?

China CBEC “Sensitive” legal topics

Although CBEC is, indeed, an interesting opportunity to enter Chinese market for several kind and categories of foreign products, some “sensitive” legal topics must be properly evaluated where a foreign company takes the decision to use CBEC.

Trademark and IP rights protection

It is common opinion that TM protection is a serious challenge in China for foreign operators. Actually, as many other topics, China as its own rules on TM registration, which represents the best means of protection of a said TM, to prevent squatting, hoarding or counterfeiting by other business operators.

On this aspect, CBEC has the same risk as traditional sales or trade channels in China. Thus, the first means to protect IPR is the registration of TM before CNIPA China Intellectual Property Administration according to Chinese TM Law and to international procedures duly applicable to the case.

Specifically referred to CBEC, main Platforms implemented their rules and tools to ensure an adequate level of protection for TM owners, and actively cooperate with TM owners to support relevant actions for TM protection. Anyway, protection from TM infringement (or squatting, or hoarding, or other unlawful misconducts perpetrated by potential competitors) is basically a preemptive strategy, based on an accurate evaluation on TM registration.

Selection of a reliable local Trade Partner

Especially for Direct international CBEC (and, also, linked to TM protection issues) it is extremely important to select a reliable local Trade Partner, key-figure for CBEC (especially where goods are sold and shipped without a bonded warehouse). On this aspect, TP must be chosen within those certified by CBEC Platforms as reliable companies (evaluation based on several parameters, such as years of experience in CBEC, English-speaking staff, skills in warehouse handling, etc). Besides this, a specific agreement must be executed between foreign operators and local TP, to specify duties and scope of appointments, not only related to mandatory tasks (management of the On-line shop on the Platform, after-sale service, complaints, recall, etc.) but also for any aspect requiring a local-based partner. Amongst them, as said, TM protection and supervision on potential counterfeiting or squatting actions.

Avv. Andrea Sorgato – China Desk, Shanghai Office – andrea.sorgato@studiozunarelli.com